States Where Teachers Make The Most Money

How Much Money Gets Taken Out of Paychecks in Every State

See where there are fewer tax withholdings.

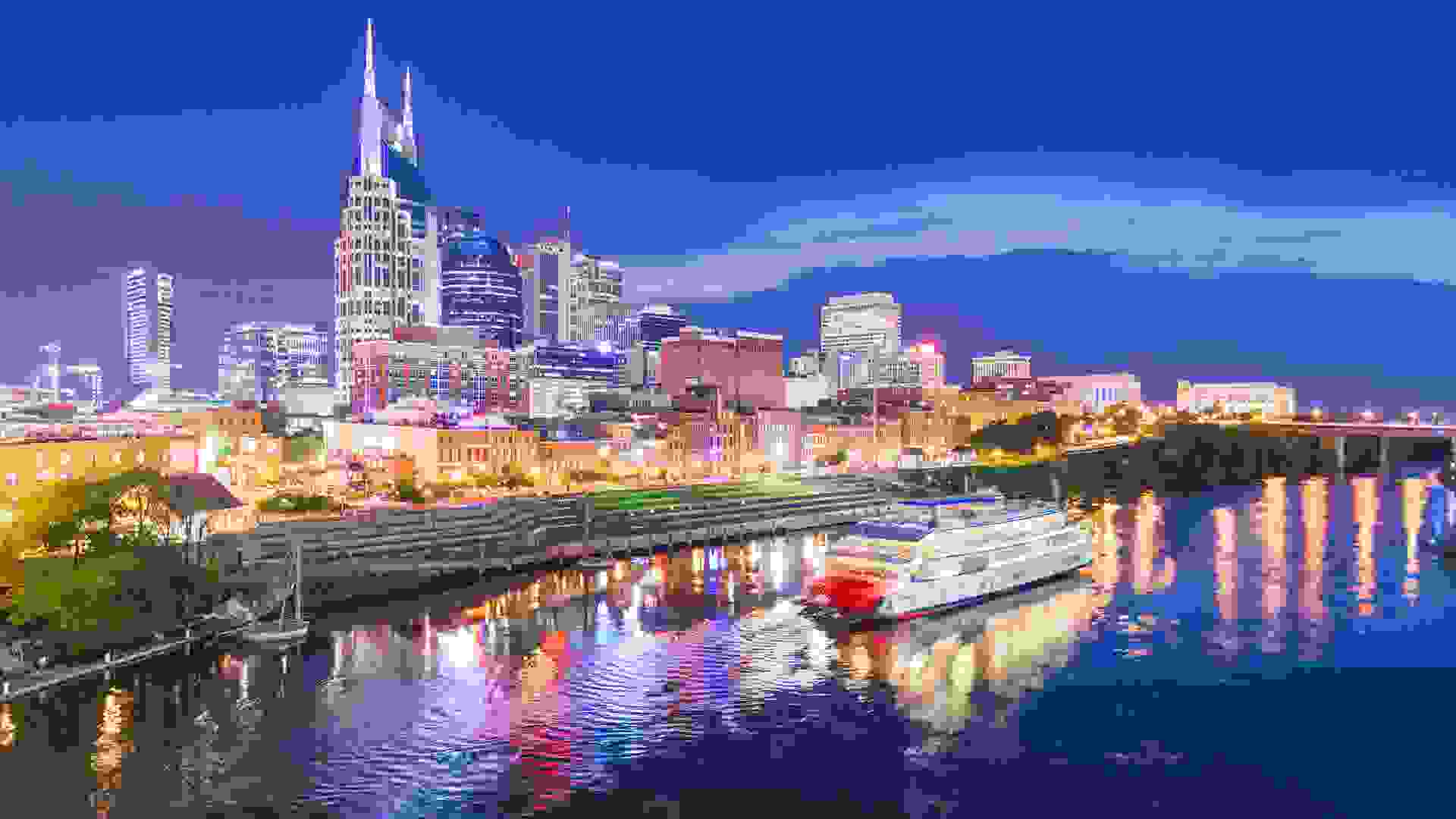

50. Tennessee

Average Income: $53,320

Single Filing

- Total income taxes paid: $8,797

- Tax burden: 16.5%

- Amount taken out of an average biweekly paycheck: $338

Joint Filing

- Total income taxes paid: $7,067

- Tax burden: 13.25%

- Amount taken out of an average biweekly paycheck: $272

Learn More: 8 New or Improved Tax Credits and Breaks for Your 2020 Return

49. Mississippi

Average Income: $45,081

Single Filing

- Total income taxes paid: $9,113

- Tax burden: 20.22%

- Amount taken out of an average biweekly paycheck: $351

Joint Filing

- Total income taxes paid: $7,293

- Tax burden: 16.18%

- Amount taken out of an average biweekly paycheck: $281

Don't Forget: All the New Numbers You Need To Know for Planning Ahead on Taxes

48. West Virginia

47. Florida

Average Income: $55,660

Single Filing

- Total income taxes paid: $9,491

- Tax burden: 17.05%

- Amount taken out of an average biweekly paycheck:$365

Joint Filing

- Total income taxes paid: $7,527

- Tax burden: 13.52%

- Amount taken out of an average biweekly paycheck: $289

Stay Safe: How To Protect Your Tax Refund From Being Stolen

46. New Mexico

Average Income: $49,754

Single Filing

- Total income taxes paid: $9,622

- Tax burden: 19.34%

- Amount taken out of an average biweekly paycheck: $370

Joint Filing

- Total income taxes paid: $7,181

- Tax burden: 14.44%

- Amount taken out of an average biweekly paycheck: $276

45. Louisiana

Average Income: $49,469

Single Filing

- Total income taxes paid: $9,744

- Tax burden: 19.69%

- Amount taken out of an average biweekly paycheck: $375

Joint Filing

- Total income taxes paid: $7,789

- Tax burden: 15.75%

- Amount taken out of an average biweekly paycheck: $300

44. Arkansas

Average Income: $47,597

Single Filing

- Total income taxes paid: $10,094

- Tax burden: 21.21%

- Amount taken out of an average biweekly paycheck: $388

Joint Filing

- Total income taxes paid: $8,260

- Tax burden: 17.36%

- Amount taken out of an average biweekly paycheck: $318

43. South Dakota

Average Income: $58,275

Single Filing

- Total income taxes paid: $10,266

- Tax burden: 17.62%

- Amount taken out of an average biweekly paycheck: $395

Joint Filing

- Total income taxes paid: $8,041

- Tax burden: 13.8%

- Amount taken out of an average biweekly paycheck: $309

42. Alabama

Average Income: $50,536

Single Filing

- Total income taxes paid: $10,587

- Tax burden: 20.95%

- Amount taken out of an average biweekly paycheck: $407

Joint Filing

- Total income taxes paid: $8,592

- Tax burden: 17%

- Amount taken out of an average biweekly paycheck: $330

Put Your Check in a Bank: Newest Checking Account Bonuses and Promotions: January 2021

41. Kentucky

Average Income: $50,589

Single Filing

- Total income taxes paid: $10,633

- Tax burden: 21.02%

- Amount taken out of an average biweekly paycheck: $409

Joint Filing

- Total income taxes paid: $8,795

- Tax burden: 17.39%

- Amount taken out of an average biweekly paycheck: $338

40. Ohio

Average Income: $56,602

Single Filing

- Total income taxes paid: $10,826

- Tax burden: 19.13%

- Amount taken out of an average biweekly paycheck: $416

Joint Filing

- Total income taxes paid: $8,768

- Tax burden: 15.5%

- Amount taken out of an average biweekly paycheck: $337

39. Oklahoma

Average Income: $52,919

Single Filing

- Total income taxes paid: $10,833

- Tax burden: 20.47%

- Amount taken out of an average biweekly paycheck: $417

Joint Filing

- Total income taxes paid: $8,644

- Tax burden: 16.34%

- Amount taken out of an average biweekly paycheck: $333

38. Nevada

Average Income: $60,365

Single Filing

- Total income taxes paid: $10,886

- Tax burden: 18.03%

- Amount taken out of an average biweekly paycheck: $419

Joint Filing

- Total income taxes paid: $8,452

- Tax burden: 14%

- Amount taken out of an average biweekly paycheck: $325

37. South Carolina

Average Income: $53,199

Single Filing

- Total income taxes paid: $11,094

- Tax burden: 20.86%

- Amount taken out of an average biweekly paycheck: $427

Joint Filing

- Total income taxes paid: $8,509

- Tax burden: 15.99%

- Amount taken out of an average biweekly paycheck: $327

36. Texas

Average Income: $61,874

Single Filing

- Total income taxes paid: $11,333

- Tax burden: 18.32%

- Amount taken out of an average biweekly paycheck: $436

Joint Filing

- Total income taxes paid: $8,748

- Tax burden: 14.14%

- Amount taken out of an average biweekly paycheck: $336

35. North Carolina

Average Income: $54,602

Single Filing

- Total income taxes paid: $11,479

- Tax burden: 21.03%

- Amount taken out of an average biweekly paycheck: $442

Joint Filing

- Total income taxes paid: $9,057

- Tax burden: 16.58%

- Amount taken out of an average biweekly paycheck: $348

34. Indiana

Average Income: $56,303

Single Filing

- Total income taxes paid: $11,500

- Tax burden: 20.43%

- Amount taken out of an average biweekly paycheck: $442

Joint Filing

- Total income taxes paid: $9,472

- Tax burden: 16.82%

- Amount taken out of an average biweekly paycheck: $364

33. Missouri

Average Income: $55,461

Single Filing

- Total income taxes paid: $11,575

- Tax burden: 20.87%

- Amount taken out of an average biweekly paycheck: $445

Joint Filing

- Total income taxes paid: $8,961

- Tax burden: 16.16%

- Amount taken out of an average biweekly paycheck: $345

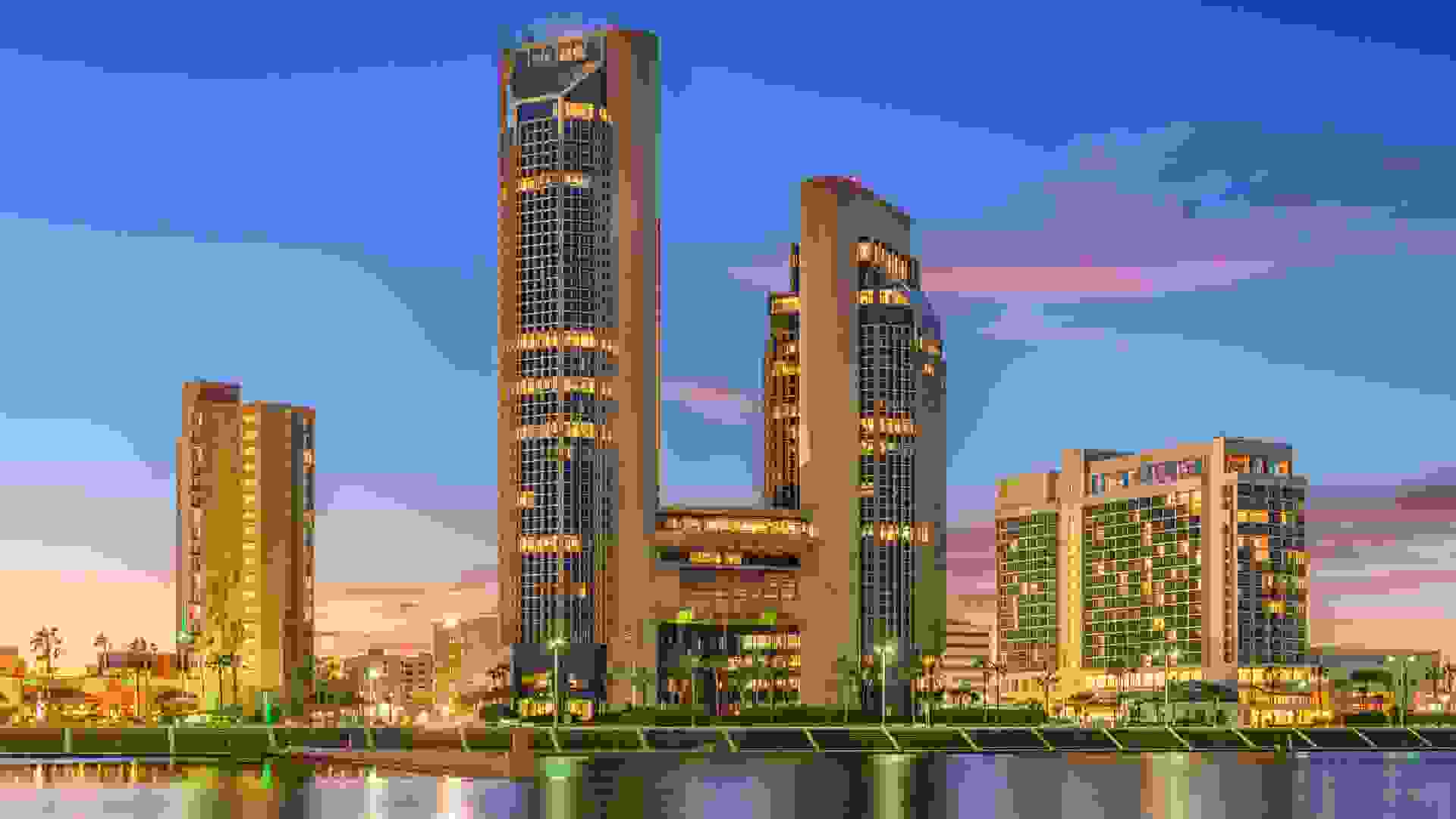

32. Arizona

Average Income: $58,945

Single Filing

- Total income taxes paid: $11,820

- Tax burden: 20.05%

- Amount taken out of an average biweekly paycheck: $455

Joint Filing

- Total income taxes paid: $9,056

- Tax burden: 15.36%

- Amount taken out of an average biweekly paycheck: $348

Related: Here's How Much Your State Collects on Every Type of Tax

31. Wyoming

Average Income: $64,049

Single Filing

- Total income taxes paid: $11,978

- Tax burden: 18.7%

- Amount taken out of an average biweekly paycheck: $461

Joint Filing

- Total income taxes paid: $9,176

- Tax burden: 14.33%

- Amount taken out of an average biweekly paycheck: $353

30. Montana

Average Income: $54,970

Single Filing

- Total income taxes paid: $12,167

- Tax burden: 22.13%

- Amount taken out of an average biweekly paycheck: $468

Joint Filing

- Total income taxes paid: $9,947

- Tax burden: 18.1%

- Amount taken out of an average biweekly paycheck: $383

29. Idaho

Average Income: $55,785

Single Filing

- Total income taxes paid: $12,269

- Tax burden: 21.99%

- Amount taken out of an average biweekly paycheck: $472

Joint Filing

- Total income taxes paid: $9,168

- Tax burden: 16.44%

- Amount taken out of an average biweekly paycheck: $353

28. Michigan

Average Income: $57,144

Single Filing

- Total income taxes paid: $12,360

- Tax burden: 21.63%

- Amount taken out of an average biweekly paycheck: $475

Joint Filing

- Total income taxes paid: $10,248

- Tax burden: 17.93%

- Amount taken out of an average biweekly paycheck: $394

27. North Dakota

Average Income: $64,894

Single Filing

- Total income taxes paid: $12,928

- Tax burden: 19.92%

- Amount taken out of an average biweekly paycheck: $497

Joint Filing

- Total income taxes paid: $9,782

- Tax burden: 15.08%

- Amount taken out of an average biweekly paycheck: $376

26. Maine

Average Income: $57,918

Single Filing

- Total income taxes paid: $13,022

- Tax burden: 22.48%

- Amount taken out of an average biweekly paycheck: $501

Joint Filing

- Total income taxes paid: $9,892

- Tax burden: 17.08%

- Amount taken out of an average biweekly paycheck: $380

25. Pennsylvania

Average Income: $61,744

Single Filing

- Total income taxes paid: $13,190

- Tax burden: 21.36%

- Amount taken out of an average biweekly paycheck: $507

Joint Filing

- Total income taxes paid: $10,618

- Tax burden: 17.2%

- Amount taken out of an average biweekly paycheck: $408

24. Georgia

Average Income: $58,700

Single Filing

- Total income taxes paid: $13,331

- Tax burden: 22.71%

- Amount taken out of an average biweekly paycheck: $513

Joint Filing

- Total income taxes paid: $10,920

- Tax burden: 18.6%

- Amount taken out of an average biweekly paycheck: $420

23. Kansas

Average Income: $59,597

Single Filing

- Total income taxes paid: $13,427

- Tax burden: 22.53%

- Amount taken out of an average biweekly paycheck: $516

Joint Filing

- Total income taxes paid: $10,391

- Tax burden: 17.44%

- Amount taken out of an average biweekly paycheck: $400

22. Vermont

Average Income: $61,973

Single Filing

- Total income taxes paid: $13,760

- Tax burden: 22.2%

- Amount taken out of an average biweekly paycheck: $529

Joint Filing

- Total income taxes paid: $10,432

- Tax burden: 16.84%

- Amount taken out of an average biweekly paycheck: $401

Grow Your Income: 6 Smart Ways to Tap into 2021's Amazing Interest Rates

21. Iowa

Average Income: $60,523

Single Filing

- Total income taxes paid: $13,807

- Tax burden: 22.81%

- Amount taken out of an average biweekly paycheck: $531

Joint Filing

- Total income taxes paid: $10,904

- Tax burden: 18.02%

- Amount taken out of an average biweekly paycheck: $419

20. Nebraska

Average Income: $61,439

Single Filing

- Total income taxes paid: $14,017

- Tax burden: 22.82%

- Amount taken out of an average biweekly paycheck: $539

Joint Filing

- Total income taxes paid: $10,380

- Tax burden: 16.89%

- Amount taken out of an average biweekly paycheck: $399

19. Wisconsin

Average Income: $61,747

Single Filing

- Total income taxes paid: $14,076

- Tax burden: 22.79%

- Amount taken out of an average biweekly paycheck: $541

Joint Filing

- Total income taxes paid: $10,781

- Tax burden: 17.46%

- Amount taken out of an average biweekly paycheck: $415

18. Washington

Average Income: $73,775

Single Filing

- Total income taxes paid: $14,862

- Tax burden: 20.14%

- Amount taken out of an average biweekly paycheck: $571

Joint Filing

- Total income taxes paid: $11,087

- Tax burden: 15.03%

- Amount taken out of an average biweekly paycheck: $426

17. Rhode Island

Average Income: $67,167

Single Filing

- Total income taxes paid: $15,087

- Tax burden: 22.46%

- Amount taken out of an average biweekly paycheck: $580

Joint Filing

- Total income taxes paid: $11,639

- Tax burden: 17.33%

- Amount taken out of an average biweekly paycheck: $448

16. Illinois

Average Income: $65,886

Single Filing

- Total income taxes paid: $15,783

- Tax burden: 23.96%

- Amount taken out of an average biweekly paycheck: $607

Joint Filing

- Total income taxes paid: $12,797

- Tax burden: 19.42%

- Amount taken out of an average biweekly paycheck: $492

15. Alaska

Average Income: $77,640

Single Filing

- Total income taxes paid: $16,007

- Tax burden: 20.62%

- Amount taken out of an average biweekly paycheck: $616

Joint Filing

- Total income taxes paid: $11,846

- Tax burden: 15.26%

- Amount taken out of an average biweekly paycheck: $456

14. Delaware

Average Income: $68,287

Single Filing

- Total income taxes paid: $16,511

- Tax burden: 24.18%

- Amount taken out of an average biweekly paycheck: $635

Joint Filing

- Total income taxes paid: $13,069

- Tax burden: 19.14%

- Amount taken out of an average biweekly paycheck: $503

13. New York

Average Income: $68,486

Single Filing

- Total income taxes paid: $16,762

- Tax burden: 24.48%

- Amount taken out of an average biweekly paycheck: $645

Joint Filing

- Total income taxes paid: $12,715

- Tax burden: 18.57%

- Amount taken out of an average biweekly paycheck: $489

12. Oregon

Average Income: $62,818

Single Filing

- Total income taxes paid: $16,809

- Tax burden: 26.76%

- Amount taken out of an average biweekly paycheck: $647

Joint Filing

- Total income taxes paid: $13,673

- Tax burden: 21.76%

- Amount taken out of an average biweekly paycheck: $526

Find Out: Here Is the Tax Burden on the Richest 1% in Every State

11. Utah

Average Income: $71,621

Single Filing

- Total income taxes paid: $17,731

- Tax burden: 24.76%

- Amount taken out of an average biweekly paycheck: $682

Joint Filing

- Total income taxes paid: $14,136

- Tax burden: 19.74%

- Amount taken out of an average biweekly paycheck: $544

10. Minnesota

Average Income: $71,306

Single Filing

- Total income taxes paid: $17,745

- Tax burden: 24.89%

- Amount taken out of an average biweekly paycheck: $683

Joint Filing

- Total income taxes paid: $13,193

- Tax burden: 18.5%

- Amount taken out of an average biweekly paycheck: $507

9. Colorado

Average Income: $72,331

Single Filing

- Total income taxes paid: $17,782

- Tax burden: 24.58%

- Amount taken out of an average biweekly paycheck: $684

Joint Filing

- Total income taxes paid: $14,152

- Tax burden: 19.57%

- Amount taken out of an average biweekly paycheck: $544

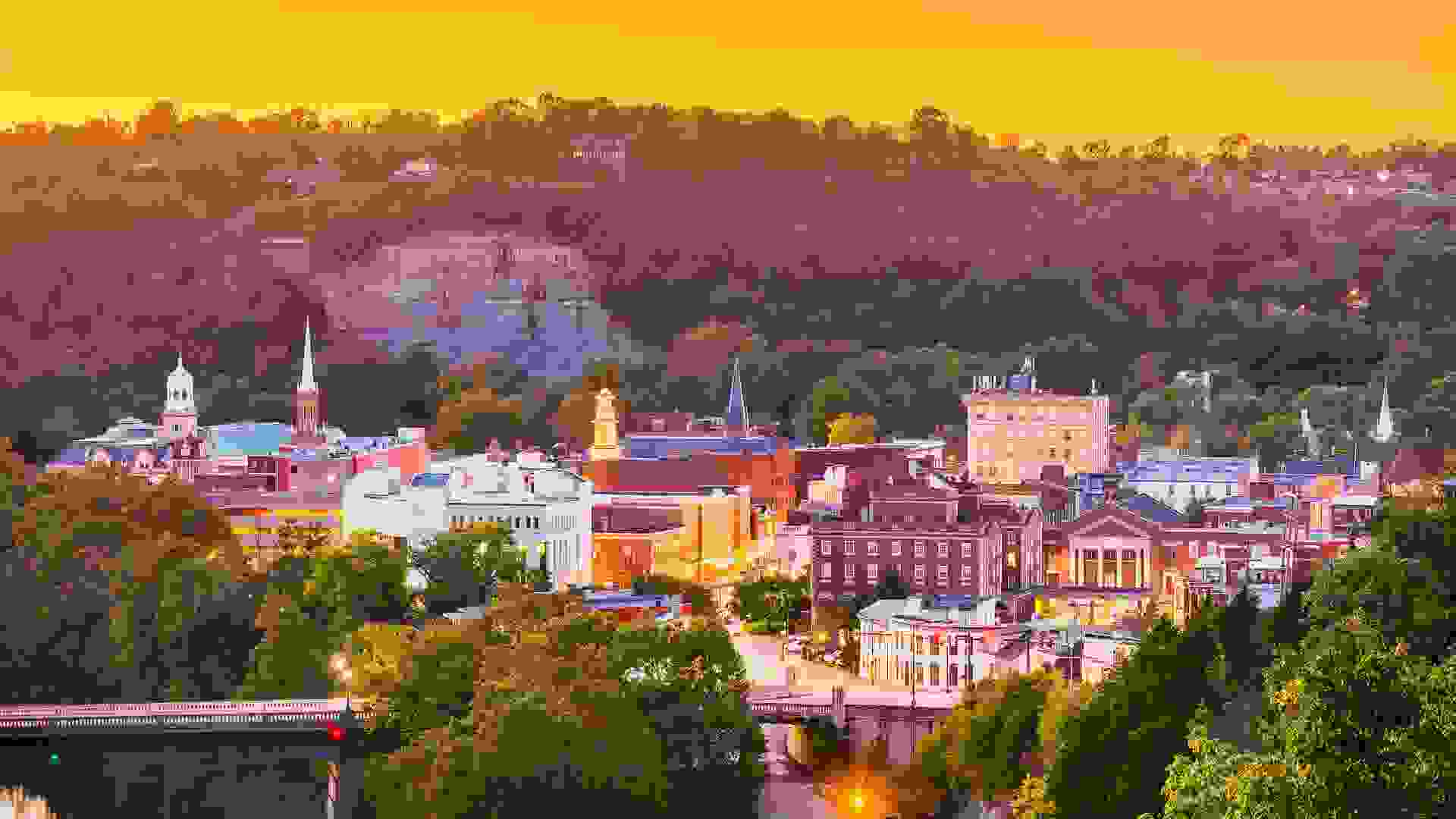

8. Virginia

Average Income: $74,222

Single Filing

- Total income taxes paid: $18,746

- Tax burden: 25.25%

- Amount taken out of an average biweekly paycheck: $721

Joint Filing

- Total income taxes paid: $14,668

- Tax burden: 19.77%

- Amount taken out of an average biweekly paycheck: $564

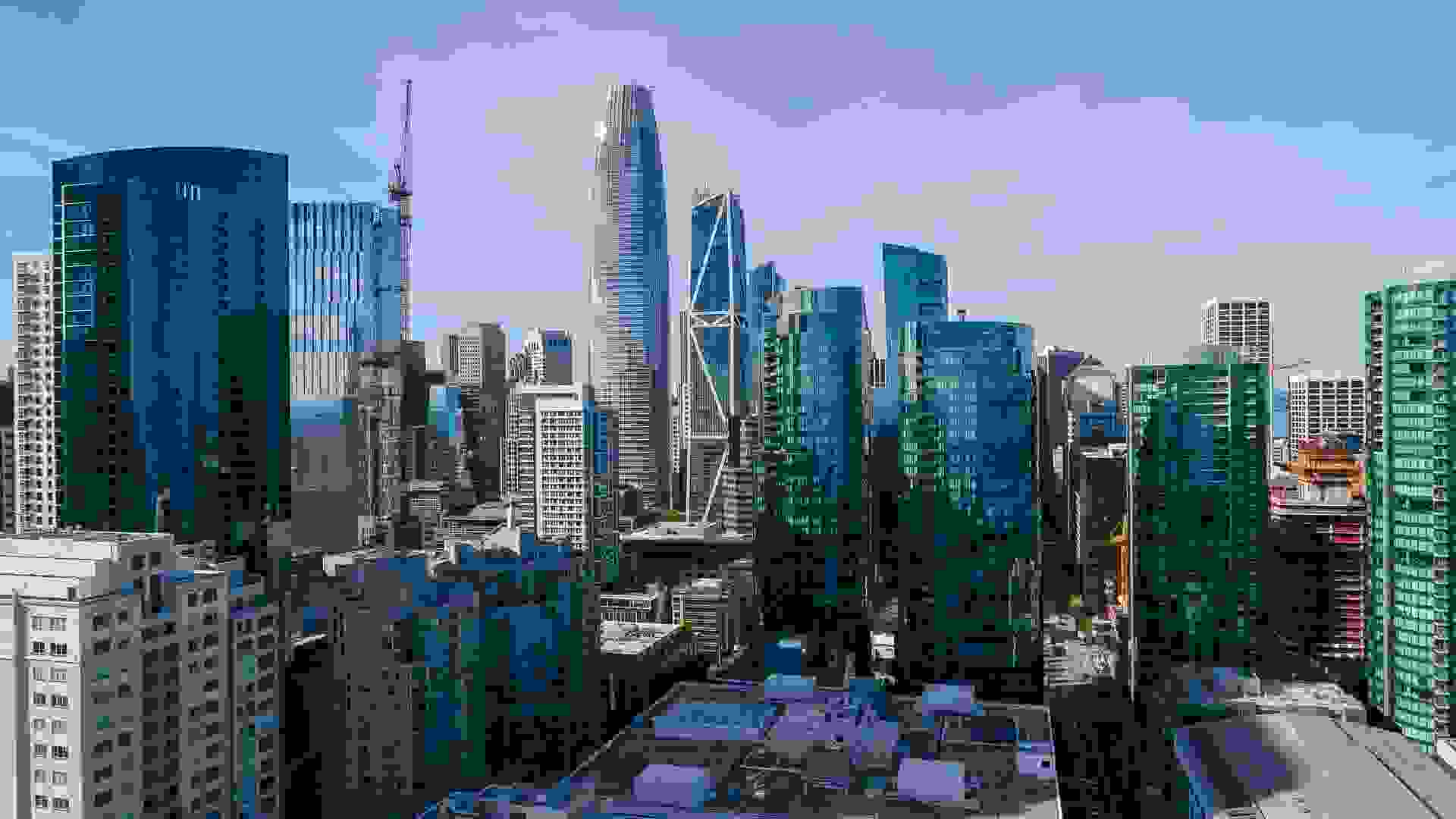

7. California

Average Income: $75,235

Single Filing

- Total income taxes paid: $19,037

- Tax burden: 25.31%

- Amount taken out of an average biweekly paycheck: $732

Joint Filing

- Total income taxes paid: $13,013

- Tax burden: 17.3%

- Amount taken out of an average biweekly paycheck: $501

Check Out: The Best and Worst States for Taxes — Ranked

6. New Hampshire

Average Income: $76,768

Single Filing

- Total income taxes paid: $19,587

- Tax burden: 25.52%

- Amount taken out of an average biweekly paycheck: $754

Joint Filing

- Total income taxes paid: $15,513

- Tax burden: 20.21%

- Amount taken out of an average biweekly paycheck: $597

5. Connecticut

Average Income: $78,444

Single Filing

- Total income taxes paid: $20,110

- Tax burden: 25.64%

- Amount taken out of an average biweekly paycheck: $774

Joint Filing

- Total income taxes paid: $15,526

- Tax burden: 19.79%

- Amount taken out of an average biweekly paycheck: $597

4. New Jersey

Average Income: $82,545

Single Filing

- Total income taxes paid: $20,596

- Tax burden: 24.95%

- Amount taken out of an average biweekly paycheck: $792

Joint Filing

- Total income taxes paid: $14,596

- Tax burden: 17.68%

- Amount taken out of an average biweekly paycheck: $561

3. Massachusetts

Average Income: $81,215

Single Filing

- Total income taxes paid: $21,129

- Tax burden: 26.02%

- Amount taken out of an average biweekly paycheck: $813

Joint Filing

- Total income taxes paid: $16,610

- Tax burden: 20.45%

- Amount taken out of an average biweekly paycheck: $639

2. Maryland

Average Income: $84,805

Single Filing

- Total income taxes paid: $21,999

- Tax burden: 25.94%

- Amount taken out of an average biweekly paycheck: $846

Joint Filing

- Total income taxes paid: $17,012

- Tax burden: 20.06%

- Amount taken out of an average biweekly paycheck: $654

1. Hawaii

Average Income: $81,275

Single Filing

- Total income taxes paid: $22,863

- Tax burden: 28.13%

- Amount taken out of an average biweekly paycheck: $879

Joint Filing

- Total income taxes paid: $17,477

- Tax burden: 21.5%

- Amount taken out of an average biweekly paycheck: $672

More From GOBankingRates

- Money's Most Influential: Where Do Americans Get Their Financial Advice?

- Everything You Need To Know About Taxes This Year

- 'Rich Dad Poor Dad' Author Robert Kiyosaki: You Should Never Say 'I Can't Afford That'

- Here's How Much You Should Have in Your 401(k) Account, Based on Your Age

Joel Anderson contributed to the reporting for this article.

Methodology: To find how much money gets taken out of paychecks in every state, GOBankingRates first found each state's median household income as sourced from the 2019 American Community Survey 5-year estimates, conducted by the United States Census Bureau. Once this was found, GOBankingRates sourced the federal and state tax brackets from the Tax Foundation's 2021 data. GOBankingRates used an in-house income tax calculator to find both the effective and marginal tax rate on each state's median income. GOBankingRates also found the Federal Insurance Contributions Act tax with its rate reported from Bloomberg. These calculations were done for a person filing their taxes as a single person and for a married couple filing jointly, using the standard deduction for each. GOBankingRates found the total income taxes paid, total tax burden and how much was taken out of a bi-weekly paycheck for each state. All data was collected on and up to date as of Jan. 6, 2021.

About the Author

States Where Teachers Make The Most Money

Source: https://www.gobankingrates.com/taxes/refunds/how-much-money-gets-taken-out-paychecks-state/

Posted by: kellyfalwye85.blogspot.com

0 Response to "States Where Teachers Make The Most Money"

Post a Comment